If you're looking for the best consolidation loan for your debt, look for one with low interest rates. Look for loans with fixed rates of repayment if you can. Stay away from fraudsters. You can use these tips to find the best loan consolidation for you.

Look for a low-interest loan consolidation to consolidate debt

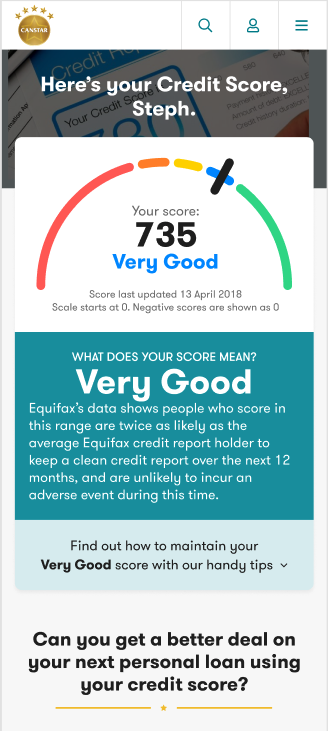

Before you apply for a debt consolidation loan, you must evaluate your financial situation. To determine if you can afford the monthly payment, a lender will evaluate your income and credit score. Your credit report will show whether your score is at the cutoff. This will make it easier for you to qualify.

A debt consolidation loan can help you get out from financial difficulties and help pay off your credit cards. These loans may not be for everyone. Bad credit will need to pay higher interest rates. You might consider a home equity loan to get a low-interest loan.

Calculate loan amount

Before you can get a consolidation loan to consolidate your debts, you must know how much you can afford. The amount of your loan depends on your income and other factors, including the balances of your existing debts. Using a debt consolidation calculator will help you decide the best consolidation option for you. This calculator will allow you enter your current debt balances and monthly payments. It also allows you to input interest rates. After entering these details, the calculator will calculate your monthly payment.

Once you know how much you can afford to borrow, you can decide which repayment plan is right for you. With the aim to help you repay your debts sooner, a debt consolidation loans will combine several loans. This option can save you money in long-term.

Fixed-rate payments are recommended

There are many lenders available that specialize in personal loan consolidation. You can find a loan that fits your financial and budget needs. For instance, you can find a loan from First Midwest Bank or Discover that has a fixed rate of less than 6% APR. They also don't charge origination fees. A loan that is suitable for your credit rating is also a good option. Lenders that specialize in bad credit loans are available.

The best debt consolidation loan will have a lower APR than the total of your current debts. This is because you will be able pay your loan off in a shorter time frame and can afford it. You should also be able to repay the loan on a reasonable time frame and pay no fees. These should be your top considerations when selecting a loan for debt consolidation. There are many lenders that offer both fixed-rate and adjustable-rate loans. The rate of interest you pay will be determined by your credit score, income, and debt-to–income ratio.

Avoid scams

Doing background checks is a key step in finding the right debt consolidation company. Do your research and look for a Better Business Bureau score. Also, make sure that their website displays a lock symbol. You should also see a physical address. Also, make sure that there are no obvious signs of fraud on the website.

One sign of a scam is a lead generation website. Although these sites may appear to be legitimate businesses, they are simply referral services. This doesn't necessarily make them scams. However, it is important to ensure that you work with a legitimate lender and not a middleman who hasn't been vetted. You should also be cautious about lead generation sites that claim affiliation with Native American Tribes. These organizations could have a license from government or an agreement signed with an Indian Tribe.

FAQ

How to build a passive stream of income?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

This means that you must understand their wants and needs. Learn how to connect with people to make them feel valued and be able to sell to them.

Next, you need to know how to convert leads to sales. To keep clients happy, you must be proficient in customer service.

Every product or service has a buyer, even though you may not be aware of it. If you know who this buyer is, your entire business can be built around him/her.

You have to put in a lot of effort to become millionaire. To become a billionaire, it takes more effort. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

You can then become a millionaire. And finally, you have to become a billionaire. The same applies to becoming a millionaire.

How do you become a billionaire. You must first be a millionaire. To achieve this, all you have to do is start earning money.

However, before you can earn money, you need to get started. Let's take a look at how we can get started.

What is the distinction between passive income, and active income.

Passive income is when you make money without having to do any work. Active income requires hardwork and effort.

If you are able to create value for somebody else, then that's called active income. You earn money when you offer a product or service that someone needs. Examples include creating a website, selling products online and writing an ebook.

Passive income is great as it allows you more time to do important things while still making money. However, most people don't like working for themselves. People choose to work for passive income, and so they invest their time and effort.

The problem with passive income is that it doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

You also run the risk of burning out if you spend too much time trying to generate passive income. It is best to get started right away. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types of passive income streams:

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate includes flipping houses, purchasing land and renting properties.

What is personal finance?

Personal finance means managing your money to reach your goals at work and home. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You no longer have to worry about paying rent or utilities every month.

You can't only learn how to manage money, it will help you achieve your goals. It can make you happier. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

Who cares about personal finances? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. There are only two hours each day that can be used to do all the important things.

Financial management will allow you to make the most of your financial knowledge.

What is the easiest passive income?

There are many different ways to make online money. Some of these take more time and effort that you might realize. How can you make extra cash easily?

The solution is to find what you enjoy, blogging, writing or selling. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. When readers click on the links in those articles, they can sign up for your emails or follow you via social media.

This is known as affiliate marketing and you can find many resources to help get started. Here's a collection of 101 affiliate marketing tips & resources.

You could also consider starting a blog as another form of passive income. Once again, you'll need to find a topic you enjoy teaching about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

There are many ways to make money online, but the best ones are usually the simplest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is called content marketing, and it's a great method to drive traffic to your website.

How can a beginner earn passive income?

Start with the basics. Learn how to create value and then discover ways to make a profit from that value.

You may have some ideas. If you do, great! You're great!

You can make money online by looking for opportunities that match you skills and interests.

There are many ways to make money while you sleep, such as by creating websites and apps.

Reviewing products is a great way to express your creativity. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what focus you choose, be sure to find something you like. If you enjoy it, you will stick with the decision for the long-term.

Once you have discovered a product or service that you are passionate about helping others purchase, you need to figure how to market it.

This can be done in two ways. You could charge a flat rate (like a freelancer), or per project (like an agencies).

In either case, once you've set your rates, you'll need to promote them. This means sharing them on social media, emailing your list, posting flyers, etc.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

Be a professional in all aspects of marketing. You never know who will review your content.

-

Be knowledgeable about the topic you are discussing. Fake experts are not appreciated.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. If someone asks for a recommendation, send it directly to them.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. You can track who opens your messages, clicks links, or signs up for your mail lists.

-

How to measure ROI: Measure the number and conversions generated by each campaign.

-

Ask your family and friends for feedback.

-

Different strategies can be tested - test them all to determine which one works best.

-

Learn and keep growing as a marketer to stay relevant.

How does a rich person make passive income?

There are two options for making money online. You can create amazing products and services that people love. This is known as "earning" money.

You can also find ways to add value to others, without having to spend your time creating products. This is known as "passive income".

Let's assume you are the CEO of an app company. Your job involves developing apps. Instead of selling apps directly to users you decide to give them away free. That's a great business model because now you don't depend on paying users. Instead, advertising revenue is your only source of income.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how most successful internet entrepreneurs earn money today. Instead of making things, they focus on creating value for others.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How to Make Money Even While You Sleep

To be successful online, you need to learn how to get to sleep when you are awake. This means you need to be able do more than wait for someone else to click your link or purchase your product. You can't make money sleeping.

This requires that you create an automated system which makes money automatically without having to do anything. Automating is the key to success.

It would help if you became an expert at building software systems that perform tasks automatically. This will allow you to focus on your business while you sleep. You can automate your job.

To find these opportunities, you should create a list with problems that you solve every day. Next, ask yourself if there are any ways you could automate them.

Once you do that, you will probably find that there are many other ways to make passive income. Now, it's time to find the most lucrative.

For example, if you are a webmaster, perhaps you could develop a website builder that automates the creation of websites. Or if you are a graphic designer, perhaps you could create templates that can be used to automate the production of logos.

Or, if you own a business, perhaps you could create a software program that allows you to manage multiple clients simultaneously. There are many options.

Automating a problem can be done as long as you have a creative solution. Automating is key to financial freedom.