A line-of credit is one method to consolidate your debts. You have two options: a secured line from your bank or one that you can get through your home. Either way, you must pay more than the minimum payment each month. This way, you can pay off your debts faster.

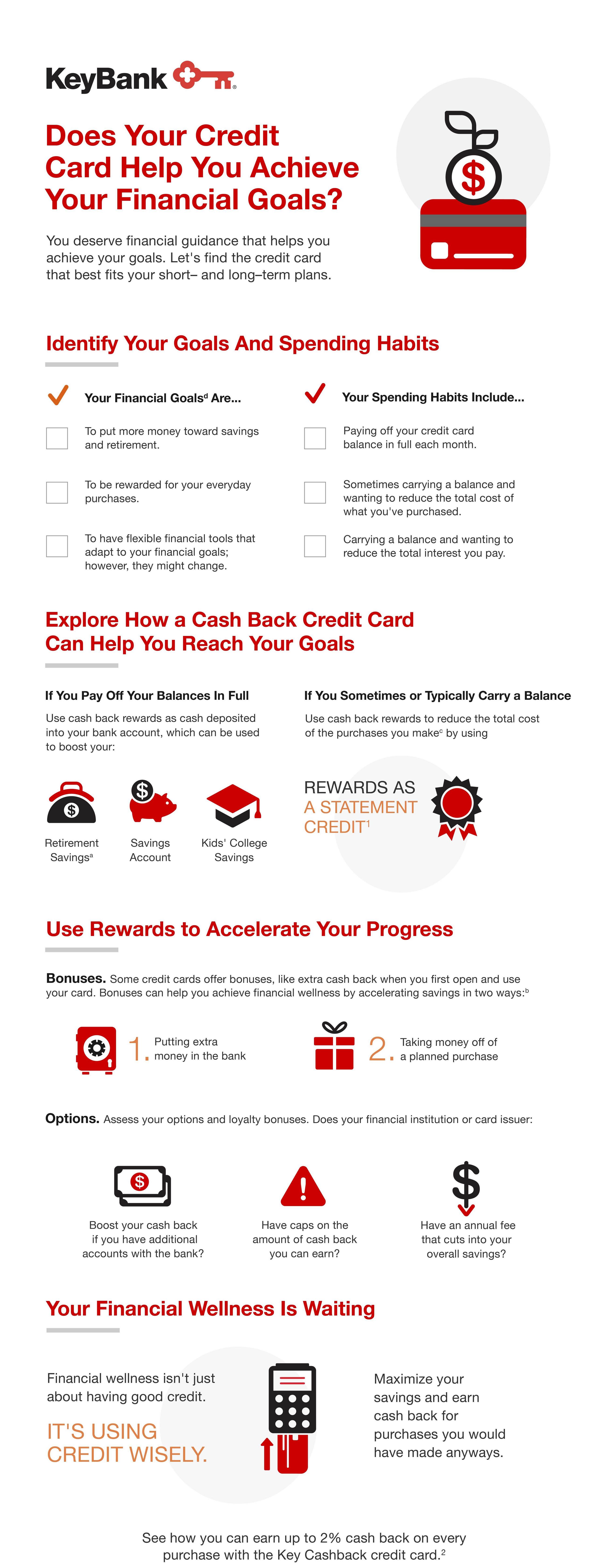

Transfer credit card balances

Balance transfer credit cards are an option for consolidating your debt. While they may help reduce your interest payments and balances you need to be aware of their potential pitfalls. You could end up paying higher interest rates or even taking on more debt. Comparing offers is the key to getting the best deal.

Before transferring your balances, it is essential to develop a budget. You should set aside a fixed amount per month to avoid getting into more debt than you need. Transfer your balances onto a new card that has a lower APR if you can. Check to see if there are any fees for balance transfers. They may be based upon the dollar amount transferred or the number. It is important to know how much it will cost and what you can afford.

Home equity line of credit

A home equity line credit is a good option if you have a lot of debts to pay. A home equity loan can help you cut interest costs by consolidating multiple debts into a single loan. This method is especially helpful if you are struggling to make your monthly repayments, or if you are overwhelmed with debt.

Because home equity lines of credit typically offer lower interest rates than credit cards or personal loans, they are an excellent option for paying off debts. The application process for a home-equity line of credit is straightforward. You have the option to choose between fixed or adjustable rate options. Citizens representatives will be able to help you throughout the entire process.

Personal loan

A personal loan is a great option if you are looking for a better way to manage your debt. The loan is usually unsecured so you don't need collateral. To determine your eligibility, lenders will often look more at your credit score than any other factors. As a result, it's important to be sure you can make the payments on your new loan and see it through to the end. Personal loans are an excellent way to consolidate your debt and can help you save money.

If you consolidate debt using a personal lender, you will usually only have one monthly payment and not several high-interest loans. While you might get a lower interest on some of your debts than others, you could also be required to pay higher interest overall. It's important to shop around for the best rates, and make sure to focus on lenders that offer a pre-qualification process.

Negotiating agreements with creditors

Negotiating with your creditors is an excellent way to reduce debt. Negotiating with creditors will allow you to reduce the amount that you owe as well as eliminate annoying phone calls. You will need to be savvy and determined when negotiating with creditors. Debt settlement is often more effective than credit counseling or bankruptcy. Creditors won't negotiate with you if your payments aren't up to 90 days late.

Before you begin negotiating with your creditors, you need to make a plan. Decide what amount you can afford to pay each creditor. You need to determine whether you can afford to pay each of them in installments or in one lump sum. Keep a log of all communication with creditors. Stay calm and truthful.

Debt management plan

A debt management program can help you get control of your finances, especially if you have several debts. Your debt counselor will contact creditors to try and negotiate lower interest rates. They can help you set up a budget to distribute to your creditors. Implementing debt management plans can be costly so it is crucial to thoroughly research each company before you sign up.

Although debt management plans have many benefits, they are not for everyone. First, your credit cards will be stopped as part of the plan. Instead, the plan will require you to use cash and debit cards. It will also stop you from opening new credit lines and taking out personal loan. Additionally, the debt management plans are only applicable to unsecured debts.

FAQ

What is the distinction between passive income, and active income.

Passive income is when you make money without having to do any work. Active income requires effort and hard work.

You create value for another person and earn active income. If you provide a service or product that someone is interested in, you can earn money. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income is great because it allows you to focus on more important things while still making money. Many people aren’t interested in working for their own money. Therefore, they opt to earn passive income by putting their efforts and time into it.

Passive income doesn't last forever, which is the problem. You might run out of money if you don't generate passive income in the right time.

You also run the risk of burning out if you spend too much time trying to generate passive income. Start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

How to create a passive income stream

To generate consistent earnings from one source, you have to understand why people buy what they buy.

This means that you must understand their wants and needs. You need to know how to connect and sell to people.

The next step is to learn how to convert leads in to sales. To keep clients happy, you must be proficient in customer service.

This is something you may not realize, but every product or service needs a buyer. Knowing who your buyer is will allow you to design your entire company around them.

To become a millionaire takes hard work. You will need to put in even more effort to become a millionaire. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Then, you will need to become millionaire. The final step is to become a millionaire. You can also become a billionaire.

How does one become billionaire? It starts with being a millionaire. All you have do is earn money to get there.

However, before you can earn money, you need to get started. Let's look at how to get going.

How do wealthy people earn passive income through investing?

There are two ways you can make money online. Another way is to make great products (or service) that people love. This is called "earning” money.

The second way is to find a way to provide value to others without spending time creating products. This is what we call "passive" or passive income.

Let's suppose you have an app company. Your job is to create apps. Instead of selling apps directly to users you decide to give them away free. This business model is great because it does not depend on paying users. Instead, your advertising revenue will be your main source.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how most successful internet entrepreneurs earn money today. Instead of making things, they focus on creating value for others.

How can a beginner make passive income?

Start with the basics. Learn how to create value and then discover ways to make a profit from that value.

You might have some ideas. If you do, great! If you do, great!

Find a job that suits your skills and interests to make money online.

You can create websites or apps that you love, and generate revenue while sleeping.

You might also enjoy reviewing products if you are more interested writing. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. It will be a long-lasting commitment.

Once you've found a product or service you'd enjoy helping others buy, you'll need to figure out how to monetize it.

You have two options. You could charge a flat rate (like a freelancer), or per project (like an agencies).

You'll need promotion for your rates in either case. This means sharing them on social media, emailing your list, posting flyers, etc.

These are three ways to improve your chances of success in marketing your business.

-

Market like a professional: Always act professional when you do anything in marketing. You never know who may be reading your content.

-

Know what your topic is before you discuss it. False experts are unattractive.

-

Spam is not a good idea. You should avoid emailing anyone in your address list unless they have asked specifically for it. Send a recommendation directly to anyone who asks.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. You can track who opens your messages, clicks links, or signs up for your mail lists.

-

You can measure your ROI by measuring the number of leads generated for each campaign and determining which campaigns are most successful in converting them.

-

Ask for feedback: Get feedback from friends and family about your services.

-

Try different strategies - you may find that some work better than others.

-

Continue to learn - keep learning so that you remain relevant as a marketer.

What's the best way to make fast money from a side-hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

You need to be able to make yourself an authority in any niche you choose. It's important to have a strong online reputation.

The best way to build a reputation is to help others solve problems. Consider how you can bring value to the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

When you really look, you will notice two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each approach has pros and cons. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it can take longer to be recognized as an expert in your area.

To be successful in either field, you must know how to identify the right customers. It takes some trial and error. However, the end result is worth it.

Which side hustles are the most lucrative in 2022

It is best to create value for others in order to make money. If you do it well, the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. As a baby, your mother gave you life. Your life will be better if you learn to walk.

You will always make more if your efforts are to be a positive influence on those around you. The truth is that the more you give, you will receive more.

Value creation is an important force that every person uses every day without knowing it. It doesn't matter if you're cooking dinner or driving your kids to school.

Today, Earth is home for nearly 7 million people. Each person creates an incredible amount of value every day. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. This is a lot more than what you earn working full-time.

Let's suppose you wanted to increase that number by doubling it. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day, there are millions upon millions of opportunities to create wealth. Selling products, services and ideas is one example.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Helping others to achieve their goals is the ultimate goal.

Create value to make it easier for yourself and others. You can get my free guide, "How to Create Value and Get Paid" here.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How to Make Money online

It is much easier to make money online than it was 10 years ago. How you invest your funds is changing as well. There are many ways you can earn passive income. However, some require substantial upfront investment. Some methods are easier than other. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out what type of investor are you. If you're looking to make quick bucks, you might find yourself attracted to programs like PTC sites (Pay per click), where you get paid for simply clicking ads. Affiliate marketing is a better option if you are more interested in long-term earnings potential.

-

Do your research. Research is essential before you make any commitment to any program. Review, testimonials and past performance records are all good places to start. You don't wish to waste your energy and time only to discover that the product doesn’t perform.

-

Start small. Do not rush to tackle a huge project. Start small and build something first. This will let you gain experience and help you determine if this type of business suits you. Once you feel confident enough to take on larger projects.

-

Get started now! It is never too late to make money online. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All you need is a good idea and some dedication. You can take action right now by implementing your ideas.