While it's possible to consolidate credit card debt, you should be aware of the risks involved. Using a consolidation service may not solve your problems, and may actually worsen them. Stop using your credit cards in order to resolve your debt problems and create a budget.

Credit card for home equity

A home equity line credit (HELOC) is a good option to consolidate credit card debt. This type of revolving credit account allows you to draw on the value of your home as needed. To pay the entire amount of debt, you must make monthly repayments. If you have little or no home equity, you can try other debt consolidation methods.

A home equity line of credit is a type of second mortgage. It works in the same way as a credit card. You can take out a loan to cover large expenses or consolidate debt that has a high interest rate. You can deduct the interest and get a lower interest rate than other credit forms.

Consolidation loan not secured

Consolidating your debt with unsecured loans is an excellent way to pay it off. These loans may be obtained through banks or financial institutions. Although they don't require collateral, these loans have higher interest rates. Moreover, you risk losing your home if you do not repay the loan on time. These loans are not for everyone.

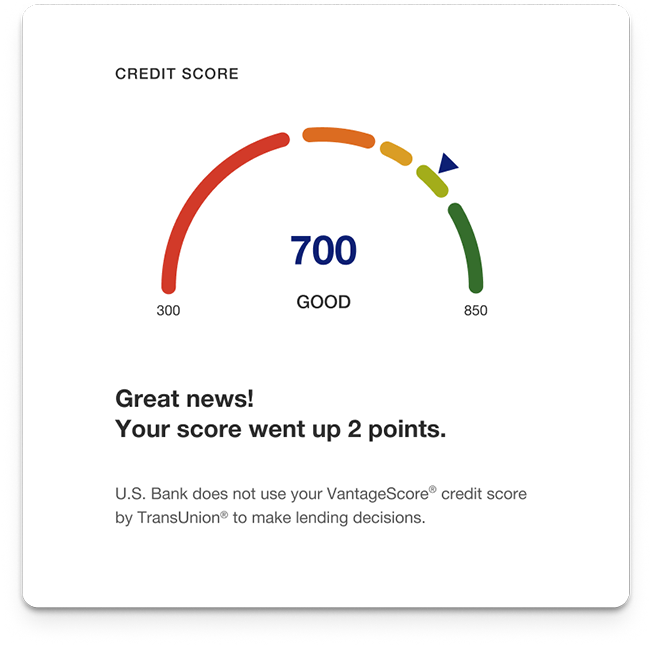

While consolidating credit card debt is not the best option for everyone, it's worth considering if your ability to repay the debt with a lower interest rate. Debt consolidation can help you reduce your credit utilization ratio, which can improve your credit score. But, it's not the right solution for all your financial problems. It requires careful management. Otherwise, it could worsen your financial situation and increase your monthly payments.

Balance transfer credit card

There are several benefits to using a balance transfer credit card to consolidate credit card debt. This will help you to reduce your monthly payments and interest rates. It also helps you to avoid late fees. Credit card companies often offer zero percent balance transfers. These benefits can be very beneficial, but it is important that you take into account your budget before transferring balances.

Balance transfer credit cards typically do not require an annual fee or a late payment fee, and many allow you to choose the date of your payments. You can also use balance transfer checks to pay off loans. In addition, they may keep your account open after the balance transfer has been completed, so you can continue to make payments.

Personal bankruptcy

Consolidating debt is a great way of managing your debt. This is a great way to consolidate your debt, pay off your credit card balances over a longer time period, reduce interest rates, and lower your monthly payments. There are some downsides to debt consolidation.

You might lose your credit card access. In some cases, the credit card companies will cancel your credit cards if you file for bankruptcy. It is possible that you will not be able use your credit card accounts in the future if there are significant amounts of debt. Consolidating your debts simplifies your debt management. It reduces the number of bills and interest rates from multiple creditors.

FAQ

Why is personal finance so important?

Personal financial management is an essential skill for anyone who wants to succeed. In a world of tight money, we are often faced with difficult decisions about how much to spend.

So why should we wait to save money? Is there something better to invest our time and effort on?

The answer is yes and no. Yes, as most people feel guilty about saving their money. You can't, as the more money that you earn, you have more investment opportunities.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

Controlling your emotions is key to financial success. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This is because you haven't learned how to manage your finances properly.

After mastering these skills, it's time to learn how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will save you money and help you pay for your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

What's the difference between passive income vs active income?

Passive income is when you earn money without doing any work. Active income requires work and effort.

Your active income comes from creating value for someone else. If you provide a service or product that someone is interested in, you can earn money. This could include selling products online or creating ebooks.

Passive income is great as it allows you more time to do important things while still making money. Most people don't want to work for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

Problem is, passive income won't last forever. If you hold off too long in generating passive income, you may run out of cash.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. Start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

How do rich people make passive income?

There are two ways you can make money online. One is to create great products/services that people love. This is called earning money.

A second option is to find a way of providing value to others without creating products. This is called passive income.

Let's say that you own an app business. Your job is to develop apps. But instead of selling the apps to users directly, you decide that they should be given away for free. That's a great business model because now you don't depend on paying users. Instead, you rely upon advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how internet entrepreneurs who are successful today make their money. They focus on providing value to others, rather than making stuff.

What side hustles make the most profit?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Some examples of active side hustles include dog walking, tutoring and selling items on eBay.

Side hustles that work for you are easy to manage and make sense. You might consider starting your own fitness business if you enjoy working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

Side hustles are available anywhere. Side hustles can be found anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you are a skilled writer, why not open your own graphic design studio?

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. So when an opportunity presents itself, you will be prepared to take it.

Side hustles aren’t about making more money. They're about building wealth and creating freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

What is the easiest way to make passive income?

There are many online ways to make money. However, most of these require more effort and time than you might think. How do you find a way to earn more money?

The solution is to find what you enjoy, blogging, writing or selling. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

You might also think about starting a blog to earn passive income. Again, you will need to find a topic which you love teaching. You can also make your site monetizable by creating ebooks, courses and videos.

While there are many options for making money online, the most effective ones are the easiest. You can make money online by building websites and blogs that offer useful information.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is content marketing. It's an excellent way to bring traffic back to your website.

What is personal finance?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You can forget about worrying about rent, utilities, or any other monthly bills.

It's not enough to learn how money management can help you make more money. It will make you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

Who cares about personal finances? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends reports that the number of searches for "personal financial" has increased by 1,600% since 2004.

People use their smartphones today to manage their finances, compare prices and build wealth. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

Bankrate.com reports that Americans spend four hours a days watching TV, listening, playing music, playing video games and surfing the web, as well as talking with their friends. That leaves only two hours a day to do everything else that matters.

Personal finance is something you can master.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

External Links

How To

You can increase cash flow by using passive income ideas

There are many online ways to make extra money without any hard work. Instead, you can make passive income at home.

Automation could also be beneficial for an existing business. Automation can be a great way to save time and increase productivity if you're thinking of starting a new business.

Your business will become more efficient the more it is automated. This will enable you to devote more time to growing your business instead of running it.

A great way to automate tasks is to outsource them. Outsourcing allows for you to focus your efforts on what really matters when running your business. By outsourcing a task you effectively delegate it to another party.

This allows you to concentrate on the core aspects of your company while leaving the details to someone else. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

It is possible to make your hobby a side hustle. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

For example, if you enjoy writing, why not write articles? Your articles can be published on many websites. These sites allow you to earn additional monthly cash because they pay per article.

Another option is to make videos. Many platforms enable you to upload videos directly onto YouTube or Vimeo. You'll receive traffic to your website and social media pages when you post these videos.

Another way to make extra money is to invest your capital in shares and stocks. Investing stocks and shares is similar investment to real estate. Instead of renting, you get paid dividends.

As part of your payout, shares you have purchased are given to shareholders. The amount you get depends on how many shares you purchase.

You can reinvest your profits in buying more shares if you decide to sell your shares. This way you'll continue to be paid dividends.