Although debt forgiveness can seem appealing to many, it has its drawbacks. It can negatively impact your credit rating and could also have tax implications. You will also have to pay taxes if the amount you owe is not paid back.

Bankruptcy

Bankruptcy is an option if you are in need of credit card debt forgiveness. If you file for bankruptcy your creditors are legally forbidden from trying to collect the debt. That means no phone calls, mail, email, or similar collection efforts. Bankruptcy also prevents creditors from pursuing lawsuits or other legal action. But, before you file for bankruptcy, it is important to know about some exceptions.

Bankruptcy can provide you with a fresh start and help you to develop new financial habits. Bankruptcy can help you avoid making costly mistakes such as not reviewing the terms of credit card offers. Although it can be tempting for people to get credit card offers right after they file bankruptcy, not many people take the time to review the fine print. This can lead to high-interest credit cards.

Although bankruptcy may seem like the fastest way out, it can have lasting effects on your credit. Bankruptcy is a permanent record on your credit for seven to 10 year. It can also impact your ability to obtain credit cards or loans in the future. Bankruptcy, a federal court process that completely erases personal debt, is an option. Therefore, creditors will try to negotiate a smaller settlement amount in order to preserve their right to collect on the debt.

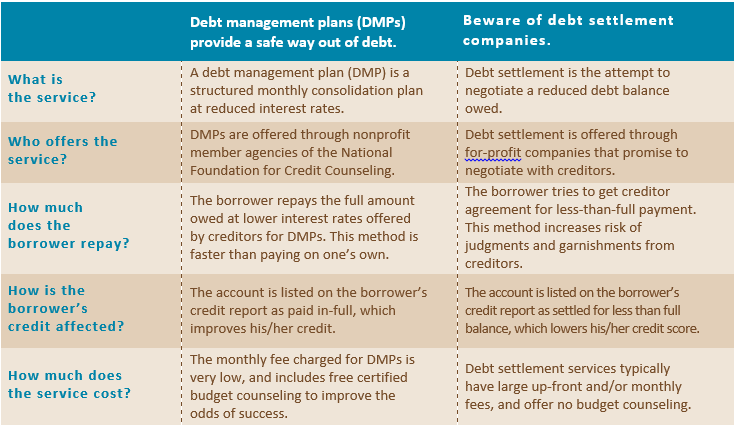

Settlement of Debt

There are two options for paying off your credit card debt: debt forgiveness or debt settlement. Both reduce the total amount and can improve your financial position. Which is better? Which one will reduce your stress? Which will improve credit scores? Find out which one is right for you by reading on.

If you have an old debt and are not paying your bills on time, your creditor could agree to a debt settlement. You can choose to receive a lump sum, or you can set up a payment plan over time. The terms and conditions of a settlement may vary depending on your specific situation. However, if the debt is legitimate, it will most likely be greatly reduced.

Direct consolidation loans

If you are considering applying for debt consolidation loans, it is important to consider both the benefits and the drawbacks. First, they can be more expensive that paying off your debts separate. If you have poor credit, they might not be available to you. Before making a decision, make sure to carefully compare the terms and interest rates of each loan.

Debt consolidation also allows you to simplify your payment schedule. Making one monthly payment will make it easier to pay off your debts. It can also help lower the interest rate. Be sure to read the terms and conditions as some offer a time limit.

When searching for a debt consolidation loan it is important to look at the APR and fees offered from different lenders. It's important to compare borrowing limits between different loans. The best loan for you is the one that fits your financial goals and budget. When you've found the right loan, you should submit an application, but be prepared to undergo a hard credit check.

FAQ

What is the distinction between passive income, and active income.

Passive income can be defined as a way to make passive income without any work. Active income requires work and effort.

Active income is when you create value for someone else. Earn money by providing a service or product to someone. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great because it allows you to focus on more important things while still making money. However, most people don't like working for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

The problem with passive income is that it doesn't last forever. If you wait too long to generate passive income, you might run out of money.

It is possible to burn out if your passive income efforts are too intense. You should start immediately. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types to passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

What is the fastest way to make money on a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You must also find a way of establishing yourself as an authority in any niche that you choose. This means that you need to build a reputation both online and offline.

The best way to build a reputation is to help others solve problems. It is important to consider how you can help the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

If you are careful, there are two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each approach has its advantages and disadvantages. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. You will also find fierce competition for these gigs.

Consulting can help you grow your business without having to worry about shipping products and providing services. However, it can take longer to be recognized as an expert in your area.

In order to succeed at either option, you need to learn how to identify the right clientele. It will take some trial-and-error. But it will pay off big in the long term.

How much debt is too much?

There is no such thing as too much cash. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. You should cut back on spending if you feel you have run out of cash.

But how much do you consider too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. That way, you won't go broke even after years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. Spend less than $2,000 per monthly if you earn $20,000 a year. And if you make $50,000, you shouldn't spend more than $5,000 per month.

The key here is to pay off debts as quickly as possible. This includes student loans and credit card bills. When these are paid off you'll have money left to save.

You should consider where you plan to put your excess income. You could lose your money if you invest in stocks or bonds. But if you choose to put it into a savings account, you can expect interest to compound over time.

Consider, for example: $100 per week is a savings goal. That would amount to $500 over five years. After six years, you would have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. You'd have close to $13,000 saved by the time you hit ten years.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. That's quite impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000 in savings, you would have more than 57,000.

It's crucial to learn how you can manage your finances effectively. Otherwise, you might wind up with far more money than you planned.

What is the easiest passive source of income?

There are many online ways to make money. But most of them require more time and effort than you might have. How do you find a way to earn more money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. When readers click on those links, sign them up to your email list or follow you on social networks.

This is called affiliate marketing. You can find plenty of resources online to help you start. Here's a collection of 101 affiliate marketing tips & resources.

Another option is to start a blog. This time, you'll need a topic to teach about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

There are many ways to make money online, but the best ones are usually the simplest. Focus on creating websites or blogs that offer valuable information if you want to make money in the online world.

Once you have created your website, share it on social media such as Facebook and Twitter. This is known content marketing.

How do you build passive income streams?

To make consistent earnings from one source you must first understand why people purchase what they do.

It is important to understand people's needs and wants. You need to know how to connect and sell to people.

The next step is to learn how to convert leads in to sales. You must also master customer service to retain satisfied clients.

Although you might not know it, every product and service has a customer. And if you know who that buyer is, you can design your entire business around serving him/her.

You have to put in a lot of effort to become millionaire. To become a billionaire, it takes more effort. Why? Why?

Then, you will need to become millionaire. Finally, you must become a billionaire. The same applies to becoming a millionaire.

How do you become a billionaire. Well, it starts with being a thousandaire. All you need to do to achieve this is to start making money.

But before you can begin earning money, you have to get started. Let's discuss how to get started.

Which side hustles are most lucrative?

Side hustles are income streams that add to your primary source of income.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types of side hustles: passive and active. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. You can also do side hustles like tutoring and dog walking.

Side hustles that make sense and work well with your lifestyle are the best. Start a fitness company if you are passionate about working out. If you love to spend time outdoors, consider becoming an independent landscaper.

There are many side hustles that you can do. Find side hustle opportunities wherever you are already spending your time, whether that's volunteering or learning.

You might open your own design studio if you are skilled in graphic design. Perhaps you are a skilled writer, why not open your own graphic design studio?

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. You'll be ready to grab the opportunity when it presents itself.

Side hustles are not just about making money. They can help you build wealth and create freedom.

And with so many ways to earn money today, there's no excuse to start one!

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

Passive Income Ideas To Improve Cash Flow

There are many online ways to make extra money without any hard work. Instead, passive income can be made from your home.

You may already have an existing business that could benefit from automation. You might be thinking about starting your own business. Automating certain parts of your workflow may help you save time as well as increase productivity.

The more automated your company becomes, the more efficient you will see it become. This allows you to spend more time growing your business than managing it.

Outsourcing tasks is an excellent way to automate them. Outsourcing allows for you to focus your efforts on what really matters when running your business. Outsourcing a task is effectively delegating it.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

A side hustle is another option. It's possible to earn extra cash by using your skills and talents to develop a product or service that is available online.

For example, if you enjoy writing, why not write articles? You can publish articles on many sites. These websites pay per article, allowing you to earn extra monthly cash.

Another option is to make videos. You can upload videos to YouTube and Vimeo via many platforms. These videos can drive traffic to your website or social media pages.

Another way to make extra money is to invest your capital in shares and stocks. Investing stocks and shares is similar investment to real estate. Instead of renting, you get paid dividends.

These shares are part of your dividend when you purchase shares. The amount of dividend you receive depends on the stock you have.

You can reinvest your profits in buying more shares if you decide to sell your shares. In this way, you will continue to get paid dividends over time.