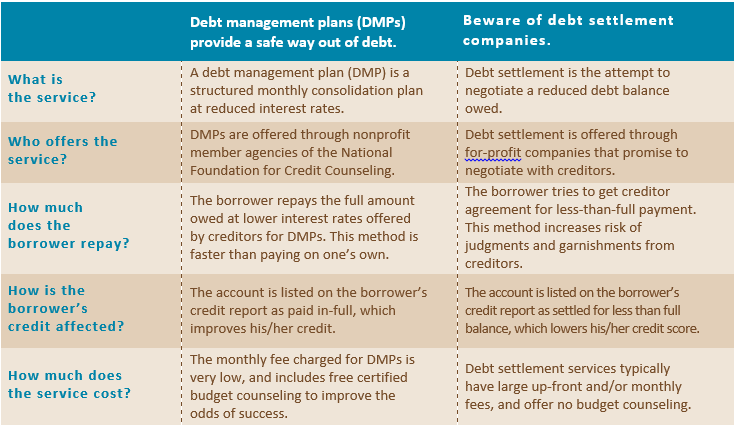

A debt settlement is a way to get rid of large amounts of debt. It also improves credit ratings. In most cases, debt settlement is better than filing for bankruptcy. There are many things you need to think about before you decide whether it is right for yourself.

You must first evaluate your financial situation in order to determine whether or not you are eligible for debt resolution. If you don't have the funds, you can't participate in this type of debt relief program. Secondly, you must have a legitimate financial hardship. This means that your monthly payments are impossible to afford. You must also have at least 90 days left on your payments.

In debt settlement, you negotiate a lower amount to your creditors. You can negotiate a lower balance, a reduction in interest rates, or a combination thereof. You can also work with a collection agency, or a legal professional to help you settle your debt. You can choose to settle your debt with either a lump sum payment or an installment plan.

A percentage of the savings that is made from a settlement are sent to the agency for debt settlement. This may amount to as much as 25% depending on the amount that was enrolled. It can be hard to predict the amount of settlement you will pay. A good debt relief agency will never list their percentages. Instead, they will have both a telephone number and an actual address.

As with any other form of debt relief, you should talk to a financial professional before committing to any form of debt settlement. They can provide information about all your options and help you choose the best one.

Although there are risks involved, debt settlement can help borrowers find financial freedom. It may allow you to purchase Christmas presents without worrying how you'll pay. It can also prevent you from getting a collection phone call.

A debt settlement program can help you make your payments easier. While it may be more expensive than other options of debt relief such as bankruptcy, it can offer the advantages of lower interest rates and better credit scores.

Your personal situation should be the most important. Unexpected financial hardships like losing your job or unexpected medical expenses can lead to debt settlement. This is a great way for you to get control of your finances.

Debt settlement may not work for you if you are behind with payments or have a high debt. It is possible that you will need to look into other options for debt relief such as a balance transfer credit or card.

For those with large amounts of debt, bankruptcy is often the last resort. Filing for bankruptcy has many disadvantages. It will remain on your credit report for as long as 7 years. Even if the bankruptcy proceeding is completed, you will have to reestablish your credit.

FAQ

What is the easiest passive income?

There are many different ways to make online money. Many of these methods require more work and time than you might be able to spare. How do you find a way to earn more money?

The solution is to find what you enjoy, blogging, writing or selling. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. When readers click on those links, sign them up to your email list or follow you on social networks.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here are some examples of 101 affiliate marketing tools, tips & resources.

As another source of passive income, you might also consider starting your own blog. It's important to choose a topic you are passionate about. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

Although there are many ways to make money online you can choose the easiest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is content marketing. It's an excellent way to bring traffic back to your website.

Which side hustles are most lucrative?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types. Passive side hustles include online businesses such as e-commerce stores, blogging, and freelancing. Side hustles that are active include tutoring, dog walking, and selling products on eBay.

Side hustles that work for you are easy to manage and make sense. Consider starting a business in fitness if your passion is working out. You may be interested in becoming a freelance landscaper if your passion is spending time outdoors.

Side hustles can be found anywhere. You can find side hustles anywhere.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you're an experienced writer so why not go ghostwriting?

Do your research before starting any side-business. You'll be ready to grab the opportunity when it presents itself.

Side hustles are not just about making money. They can help you build wealth and create freedom.

With so many options to make money, there is no reason to stop starting one.

How much debt are you allowed to take on?

It's essential to keep in mind that there is such a thing as too much money. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. So when you find yourself running low on funds, make sure you cut back on spending.

But how much do you consider too much? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. Even after years of saving, this will ensure you won't go broke.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. Spend less than $2,000 per monthly if you earn $20,000 a year. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It's important to pay off any debts as soon and as quickly as you can. This includes credit card bills, student loans, car payments, etc. When these are paid off you'll have money left to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

For example, let's say you set aside $100 weekly for savings. Over five years, that would add up to $500. After six years, you would have $1,000 saved. You'd have almost $3,000 in savings by the end of eight years. When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. That's pretty impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 you would now have $57,000.

It is important to know how to manage your money effectively. You might end up with more money than you expected.

What is the fastest way you can make money in a side job?

If you want to make money quickly, it's not enough to create a product or a service that solves an individual's problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. This means that you need to build a reputation both online and offline.

Helping people solve problems is the best way build a reputation. Ask yourself how you can be of value to your community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

You will see two main side hustles if you pay attention. The first type is selling products and services directly, while the second involves offering consulting services.

There are pros and cons to each approach. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. In addition, the competition for these kinds of gigs is fierce.

Consulting can help you grow your business without having to worry about shipping products and providing services. But, it takes longer to become an expert in your chosen field.

To be successful in either field, you must know how to identify the right customers. This can take some trial and error. But, in the end, it pays big.

What's the difference between passive income vs active income?

Passive income means that you can make money with little effort. Active income requires hardwork and effort.

If you are able to create value for somebody else, then that's called active income. It is when someone buys a product or service you have created. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great because it allows you to focus on more important things while still making money. However, most people don't like working for themselves. People choose to work for passive income, and so they invest their time and effort.

Passive income isn't sustainable forever. If you are not quick enough to start generating passive income you could run out.

It is possible to burn out if your passive income efforts are too intense. Start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are 3 types of passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

How do wealthy people earn passive income through investing?

There are two options for making money online. You can create amazing products and services that people love. This is called "earning" money.

A second option is to find a way of providing value to others without creating products. This is "passive" income.

Let's assume you are the CEO of an app company. Your job involves developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. This business model is great because it does not depend on paying users. Instead, you can rely on advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how internet entrepreneurs who are successful today make their money. They give value to others rather than making stuff.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

You can increase cash flow by using passive income ideas

There are many online ways to make extra money without any hard work. Instead, you can make passive income at home.

Perhaps you have an existing business which could benefit from automation. If you are considering starting your own business, automating parts can help you save money and increase productivity.

The more automated your business becomes, the more efficient it will become. This allows you to spend more time growing your business than managing it.

Outsourcing tasks is a great method to automate them. Outsourcing allows your business to be more focused on what is important. You are effectively outsourcing a task and delegating it.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

A side hustle is another option. You can also use your talents to create an online product or service. This will help you generate additional cash flow.

If you like writing, why not create articles? Your articles can be published on many websites. These websites allow you to make additional monthly cash by paying per article.

Making videos is also possible. Many platforms allow you to upload videos to YouTube or Vimeo. Posting these videos will increase traffic to your social media pages and website.

Another way to make extra money is to invest your capital in shares and stocks. Investing in stocks and shares is similar to investing in real estate. Instead of renting, you get paid dividends.

You receive shares as part of your dividend, when you buy shares. The amount of your dividend will depend on how much stock is purchased.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. In this way, you will continue to get paid dividends over time.